X

Anti-Fraud, Bribery & Corruption

Definition

In the broadest sense, fraud can encompass any crime for gain that uses deception as its principal method of operation. More precisely, fraud is defined as: “A knowing misrepresentation of the truth or concealment of a material fact to induce another to act to his or her detriment”. Indicatively, for the purpose of this document, fraud may involve:

-

• manipulation, falsification or alteration of records or documents.

-

• suppression or omission of the effects of transactions from records or documents.

-

• recording of transactions without substance.

-

• misappropriation (theft) or wilful destruction or loss of assets including cash.

-

• deliberate misapplication of accounting or other regulations or policies.

-

• bribery and corruption.

-

• usurpation of corporate interests for personal gain.

-

• payment or receipts of bribes, kickbacks, or other inappropriate payments.

• participation in sham or fraudulent transactions.

-

• participation in sham or fraudulent transactions.

Bribery applies to the giving of anything of value, not only money. This includes providing business opportunities, favourable contracts, stock options, gifts, and entertainment.

Preventing Fraud Against Consumers

Habib Qatar takes active steps to prevent consumer fraud. Consumer fraud occurs when criminals convince or trick consumers to transfer money to the criminal or the criminal’s associates. Criminals use a variety of scams to perpetrate such crimes, and they often target the most vulnerable members of society—particularly the elderly. It is therefore imperative that staff and customers of Habib Qatar are always aware of potential fraud-related activity.

Consumer fraud generally involves criminals conducting scams to persuade consumers to transfer money to them that might sound financially appealing to the consumer but are in fact an attempt to steal from the consumer. Most consumer fraud involves the victim’s perception that they will receive some sort of financial gain or that they are helping a friend, relative, or loved one. A common theme in all consumer fraud schemes is that the consumer has never met the receiver in person. All FLA’s must take the steps described in this Manual to detect, deter, and report consumer fraud.

Common Consumer Fraud Types:

1. Advanced fee or prepayments scam

Victim is asked to pay upfront fees for financial services which are never provided. Victims often send a succession of transactions for payment of various upfront fees. Methods: credit card, grant, loan, inheritance, investment.

2. Anti-Virus Scam

A victim is contacted by someone claiming they are from a well-known computer or software company and a virus has been detected on the victim’s computer. The victim is advised that the virus can be removed, and the computer protected for a small fee with a payment by either credit card or a money transfer. There was no virus on the computer and the victim has just lost the money they sent for the protection.

3. Charity Scam

The victim is often contacted by e-mail, mail or phone by someone asking for a donation to be sent by money transfer to an individual to help victims of a recent current event, such as a disaster or emergency (such as a flood, cyclone, or earthquake). Legitimate charity organizations will never ask for donations to be sent from one individual to another individual through a money transfer service.

4. Emergency Scam

Victims are led to believe that they are sending funds to assist a friend or loved one in urgent need. The victim sends the money with urgency as the victim’s natural concern for a loved one is exploited.

5. Employment Scam

Victim responds to a job posting and is hired for the fictitious job and sends a fake cheque for job related expenses. The cheque amount exceeds the victim’s expenses, and the victim sends the remaining funds back using a money transfer. The cheque bounces and the victim are responsible for the full amount.

6. Fake (Counterfeit) Cheque Scam

Victims are often sent a cheque as a part of a scam and told to deposit the cheque and use the funds for employment expenses, internet purchases, mystery shopping, etc. The cheque is fake (counterfeit), and the victim is left responsible for any funds used from thecheque. Remember, funds from a cheque deposited into an account should not be used until the cheque officially clears, which can take weeks.

7. Fake (Counterfeit) Currency Scam

Individuals can encounter fraudster trying to approach them with foreign currency for Qatari or local riyals making stories for not being able to change currency themselves, handing the individual with counterfeit currency. The same can be experienced with local currency where the fraudster wanted to change bigger denomination note handing the customer with counterfeit note.

8. Grandparent Scam

This scam is a variation on the Emergency Scam. The victim is contacted by an individual pretending to be a grandchild in distress, or a person of authority such as a medical professional, law enforcement officer, or attorney. The fraudster describes an urgent situation or emergency (bail, medical expenses, emergency travel funds) involving the grandchild that needs a money transfer to be sent immediately. No emergency has occurred, and the victim who sent money to help their grandchild has lost their money.

9. Immigration Scam

A victim receives a call from someone claiming to be an immigration official saying there is a problem with the victim’s immigration record. Personal information and sensitive details related to the victim’s immigration status may be provided to make the story seem more legitimate. Immediate payment is demanded to fix any issues with the victim’s record and deportation, or imprisonment may be threatened if payment is not made immediately by money transfer.

10. Internet Purchase Scam

The victim sends money for the purchase of items ordered online (e.g. pets, cars). Items are often advertised on Craigslist, eBay, Alibaba, etc. After the money is sent, the victim never receives the merchandise.

11. Tax Scam

Victim is contacted by someone claiming to be from a governmental agency saying that money is owed for taxes, and it must be paid immediately to avoid arrest, deportation, or suspension of driver’s license/passport. The victim is instructed to send a money transfer or purchase a pre-loaded debit card to pay the taxes. Government agencies will never demand immediate payment or call about taxes without first having mailed a bill.

12. Lottery or another Prize Scam

Victims are told that they have won a lottery, prize or sweepstakes and that money must be sent to cover the taxes or fees on the winnings. The victim may receive a cheque for part of the winnings and once the cheque is deposited and money is sent, the cheque bounces.

13. Mystery Shopping Scam

The fraudster contacts the victim through an employment website, or the victim responds to an ad about an employment opportunity to evaluate a money transfer service. The fraudster often sends the victim a cheque to deposit and instructs the victim to send a money transfer, keeping a portion of the cheque for their pay. The victim sends the money, the fraudster picks it up, and when the cheque bounces the victim is left responsible for the full amount.

14. Overpayment Scam

The fraudster sends the victim a cheque that appears to be valid as payment for a service or product. Typically, the amount of the cheque exceeds what the victim expects to receive, and the fraudster tells the victim to send the excess back using a money transfer. When the cheque bounces, the victim is left responsible for the full amount.

15. Relationship Scam

Victims are led to believe that they have a personal relationship with someone they met online often by social media, in an online forum or on a dating website. The victim is often emotionally invested, often referring to the recipient as a fiancée and believes they are.

sending money for travel or medical expenses. In the end, the fraudster steals from the victim and no relationship is ever formed.

16. Rental property Scam

Victim sends money for deposit on a rental property and never receives access to the rental property or the victim may also be the property owner who is sent a cheque from the renter and asked to send a portion of the cheque back using a money transfer and the cheque bounces.

All elder and dependent adult consumers should be asked if they have met the person, they are sending money to because they are highly vulnerable to telephone or online fraud. If it becomes clear that the sender is not sure if the receiver is legitimate, then the Associate should refuse to process the transaction. If the elder person is sending a grandchild, the Associate must always ask the grandparent if they have called their grandchild to verify that the emergency is real.

Prevention:

We request our customers to be more responsible and follow certain steps to be vigilant such as:

- To be very careful in sharing personal banking information or personal information which can be used as identification information.

- Do not share your passwords or OTP with anyone under any circumstances as Habib Qatar International Exchange Ltd or any of its employees including other banks and wallet companies will never call you asking for this information.

- If you receive any call from anyone informing you to share your password or OTP due to any of your account being blocked or needs to be updated, it means you are being a victim of online fraud and we urge our customers to visit any of our branches to confirm this information.

- Habib Qatar International Exchange Ltd, most banks and online application will automatically send you SMS alerts on message on your mobile/online account when you make a purchase or pay for the transaction using their payment platform.

CONSUMER PROTECTION PROGRAM

A department has been formed by regulators aiming to protect the consumer, spread financial and banking awareness. The duties and powers of this department shall be as follows:

- a. To protect the customers of banks, investment companies, finance companies and exchange houses.

- b. To make sure that the banks, investment companies, finance companies, and exchange houses are working as per the sound financial and banking principles.

- c. To receive customers complaints and if possible, to settle them.

- d. To spread banking awareness in the country.

-

e. The exchange house’s Liaison Officer shall be responsible for dealing with customer and public complaints and to be assigned the following duties:

- To deal with customers and public complaints and respond to them within a minimum one week.

- To prepare and save records of submitted complaints which must be ready when demanded.

Habib Qatar Exchange will follow and adhere to Consumer Protection Program. We will register, document all customer complaints, and try to solve them within a week, if for any reason it takes more time to resolve any issues, the same will be notified to the customer.

X

AML & CFT COMPLIANCE POLICY

OVERVIEW

This Compliance Manual has been prepared aiming to update the branches of Habib Qatar International Exchange Ltd. Doha – Qatar, its officers and staffs to enable them to: Prevent and detect money laundering; Identify suspicious activities; Comply with the provisions of Law No. (20) of 2019 on ML/TF & CPF and the provisions of this Manual; and Adhere to the requirements of QCB and its QFIU, and other institutions regulating financial transactions in Qatar

Scope of Policy:

This Policy guide and the procedures mentioned herein shall be applicable at Habib Qatar International Exchange Ltd entirely including the company’s branches and its Head Office.

Services and Products:

Habib Qatar Exchange is classified as financial service institution, which renders the following services and products according to the license issued by the Qatar Central Bank. Thereupon all transactions, services and products of the company are subject to Law of Anti-Money Laundering (AML) and Combating Financing of Terrorism (CFT) and the regulation thereof.

- Selling and purchasing the foreign currencies.

- Transferring and receiving wire transfers.

Money Laundering:

Money laundering is the illegal process of concealing the origins of money obtained illegally by passing it through a complex sequence of banking transfers or commercial transactions. The overall scheme of this process returns the "clean" money to the launderer in an obscure and indirect way.

Terrorist Financing:

The importance of combating terrorist financing Terrorists needs money and other assets, for weapons but also training, travel and accommodation to plan and execute their attacks and develop as an organization. Countering terrorism financing is therefore an essential part of the global fight against terror threat.

Proliferation: (PWMD)

Rapid increase in the number or amount of something. Proliferation of Nuclear proliferation is the spread of nuclear weapons, fissionable material, and weapons-applicable nuclear technology and information to nations not recognized as "Nuclear Weapon States" by the Treaty on the Non-Proliferation of Nuclear Weapons, commonly known as the Non-Proliferation Treaty or NPT. Proliferation, or the spread of weapons of mass destruction, does not only involve the development or purchase of these weapons and their means of delivery as such, but also buying or otherwise obtaining (procuring) the goods and knowledge required for WMD development.

Objectives and Purpose

Ensuring the commitment of Habib Qatar Exchange with the provisions of Law No. (20) of 2019 on Anti-Money Laundering (AML) and Combating Financing of Terrorism (CFT) and the instructions issued by Qatar Central Bank. Detecting, preventing, and reporting the activities of money laundering and terrorist financing and proliferation financing at Habib Qatar Exchange and the branches thereof. Protecting Habib Qatar Exchange and preventing the utilization thereof as channel to perform illegal transactions created by the money laundering or terrorist financing or any other illegal activities.

Know Your Customer – KYC

The most important measure in combating money laundering which originates from the counter. We should have a reasonable knowledge of the customer (KYC) particularly when the transaction takes place for a larger amount of money. It is like categorizing customers in order to know, relatively, whether he has the capability to remit huge value of money.

CDD (Customer Due Diligence)

Customer Due Diligence information comprises the facts about a customer that should enable an organisation to assess the extent to which the customer exposes it to a range of risks. These risks include money laundering and terrorist financing.

Enhanced Due Diligence

We conduct enhanced CDD measures and enhanced on-going monitoring in cases where it is required under the provisions of Law or regulations, or when there is perception of high risk or money laundering or terrorist financing.

Beneficial Ownership:

Beneficial ownership is a term in domestic and international commercial law which refers to the natural person or persons "who ultimately own or control a legal entity or arrangement, such as a company, a trust, or a foundation".

Politically Exposed Persons (PEP)

Persons who are or have been entrusted with prominent public functions in a foreign country or territory, as well as members of such person’s family or those closely associated with those persons. The prominent public functions may in this regard include: Heads of State, Heads of Government, Ministers, Deputy or Assistant Ministers, Members of Parliament, Senior politicians or important political party officials, Judicial official, Members of boards of Central Banks, Ambassadors & Charges d’ affaires, High ranking officers of armed forces, Senior executives of state-owned corporations.

Risk-based Approach

Consistent with our Company’s adoption of a rigorous compliance regime, senior management has performed an assessment and documented the risk of Money laundering, terrorist financing. Using the risk-based approach, we have identified potential high risks of Money laundering, terrorist financing as it pertains to our Company and we have developed strategies to mitigate them. We have included these strategies as part of our policies and procedures.

Non-Profit Organisation:

Includes an entity, other than an individual, that primarily engages in raising or distributing funds for charitable, religious, cultural, educational, social, fraternal or similar purposes or carries out other types of charitable or similar acts. As part of Habib Qatar policy, we do not make transactions to charitable or non- profitable organizations or offer any financial services to humanitarian, cooperative and vocational associations, and societies. Habib Qatar will not establish any business relationship with Trust, Clubs and NPOs.

Staff Training

Training of employees and managers are essential in this changing environment. It is an important activity which helps in improving the competency of employees. Training gives a lot of benefits to the employees such as improvement in efficiency and effectiveness, development of self-confidence and assists everyone in self-management. Therefore, training is important due to, Environmental changes, Organizational Complexity, Human relations, to match employee specifications with the job requirements and organizational needs. Habib Qatar Exchange takes responsibility to train our staff on ML/TF and CPF regulations, policies, and procedures.

Record Keeping

Habib Qatar Exchange should update these data periodically and ensure that the judicial authorities and competent authorities entrusted with the enforcement of ML/TF Law have timely access to these documents and records, as and when necessary. The documents, data and record keeping will be for a minimum of 10 years.

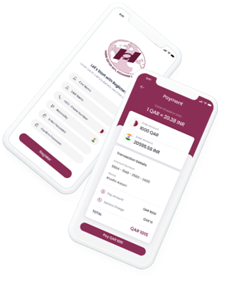

1.00 QAR =

1.00 QAR =

Ground level (G-038) - City Center Mall, At the basement of Carrefour hypermarket, West Bay, Doha Email: citycentre@hqie.com.qa

Ground level (G-038) - City Center Mall, At the basement of Carrefour hypermarket, West Bay, Doha Email: citycentre@hqie.com.qa

Tel: 4463-1978 / 4442-5151

Tel: 4463-1978 / 4442-5151

Al-Farabi Street, Near Qatar Airways Accomodation , P.O Box 1188 , Doha Qatar

Al-Farabi Street, Near Qatar Airways Accomodation , P.O Box 1188 , Doha Qatar

+974 - 44328853 / 44434143

+974 - 44328853 / 44434143

Adjacent Grand Mart Near Thakhira roundadout P.O Box 1188, Aikhor, Qatar Adjacent Grand Mart

Adjacent Grand Mart Near Thakhira roundadout P.O Box 1188, Aikhor, Qatar Adjacent Grand Mart

+974 - 44377182

+974 - 44377182

33.580 BDT

33.580 BDT

4600.010 IDR

4600.010 IDR

25.170 INR

25.170 INR

5.160 JOD

5.160 JOD

84.930 LKR

84.930 LKR

40.220 NPR

40.220 NPR

16.170 PHP

16.170 PHP

77.260 PKR

77.260 PKR

0.780 TND

0.780 TND